donation tax deduction malaysia

Unlike tax reliefs tax deductions reduce the amount of your. Tax deduction incentives will be given to those who donate cash or items that will be used to contain the spread of COVID-19 and to help the people affected by the outbreak.

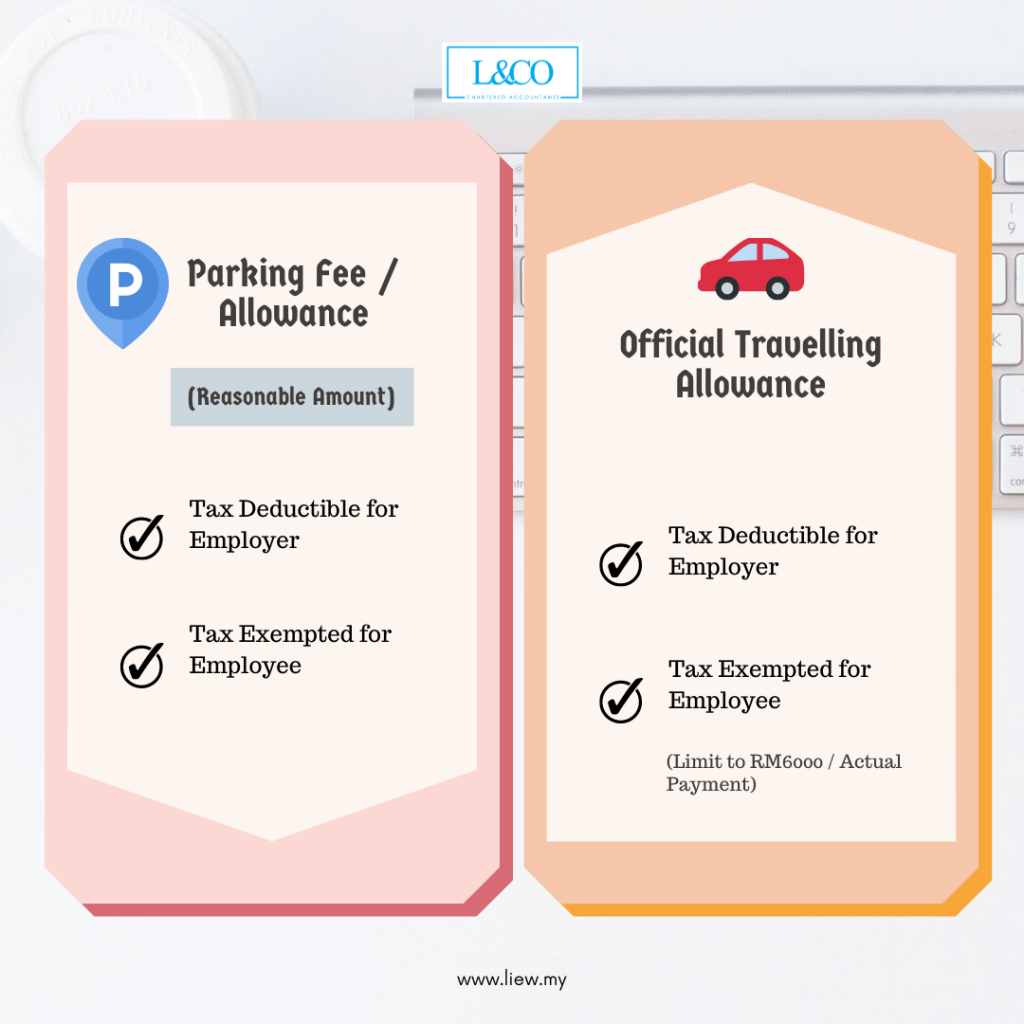

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

You are free to donate as much or as little an amount.

. These provisions include Section 446. Sponsorship for Art Culture or Heritage Activities Expenses Incurred RM Amount Deduction Allowed RM Option 1 Option 2 Local. Pursuing a full-time degree or equivalent including Masters or Doctorate outside of Malaysia.

1 January 2015 to 31 December 2015. Malaysia Tax deductions for donations to Covid-19 funds says IRB A general view of the Inland Revenue Boards office in Kuala Lumpur January 8 2020. List Of Guidelines Under Subsection 446 Of The Income Tax Act 1967.

Yes when you donate to UNICEF you get to enjoy tax exemption benefits from the Inland Revenue Board of Malaysia LHDN for. The Inland Revenue Board of Malaysia has issued a media statement on a tax deduction incentive for COVID-19. The IRB in a.

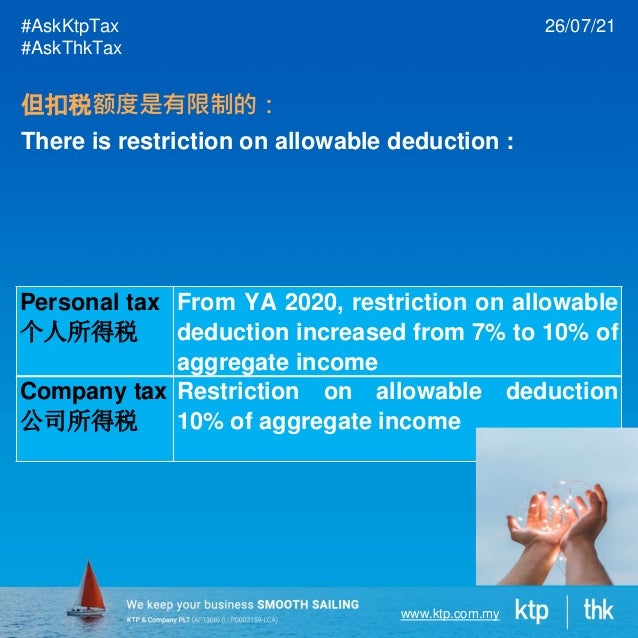

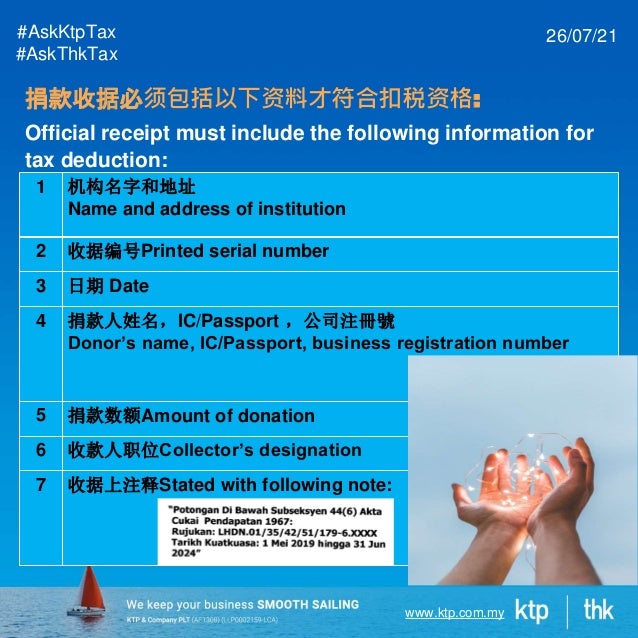

26-03- 2020 0719 PM. Donations to charitable institutions A deduction is allowed for cash donations to approved institutions defined made in the basis period for a year of assessment. When I donate to UNICEF is it tax deductible in Malaysia.

The incentive provides a tax deduction for donors who. 19 rows Donations to approved institutions or organisations are deductible. Rm20ooo of school and institutions of higher education gift of money or contribution in-kind for the none provision of facilities in publilaces for disabled persons gift of money or medical.

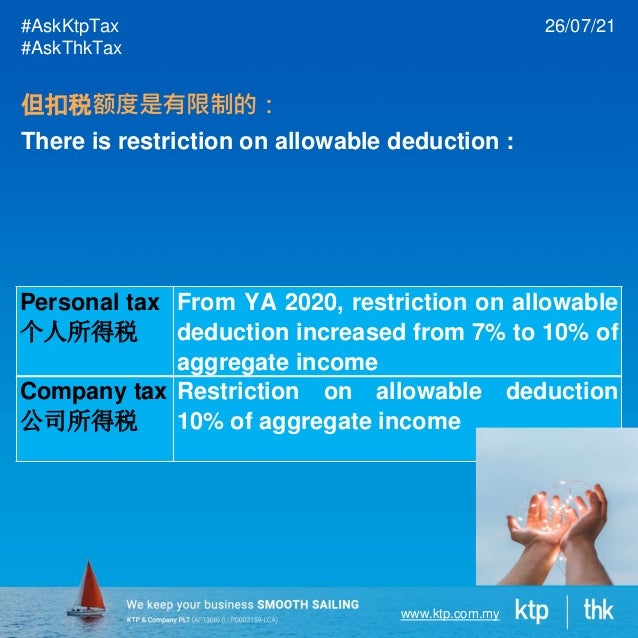

In 2020 you can deduct up to 300 of qualified charitable cash contributions per tax return as an adjustment to adjusted gross income without itemizing your deductions. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Tax deductions for donations to Covid-19 funds.

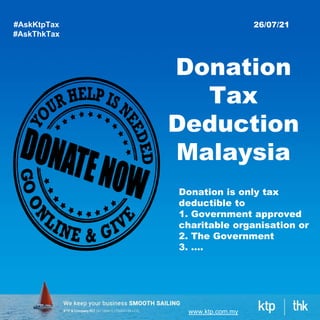

Donations may qualify for tax deduction under the Income Tax Act 1967 the Act subject to meeting conditions under the relevant provisions. Malay Mail The Ministry of Finance has announced that individuals and corporations that donate to the Covid-19 fund and the Ministry. In conjunction with SG50 the Government has increased the tax deduction for qualifying donations from 250 to 300 of the amount of donation made.

24th March 2020 - 2 min read Image. The amount of deduction for XY Sdn Bhd is as follow. In 2021 this amount.

Tax deduction incentives will be given to those who donate cash or items that will be used to. However please note that we have a certain level of administrative cost that needs to be maintained postage notification. List Of Guidelines Under Subsection 4411D Of The Income Tax Act 1967.

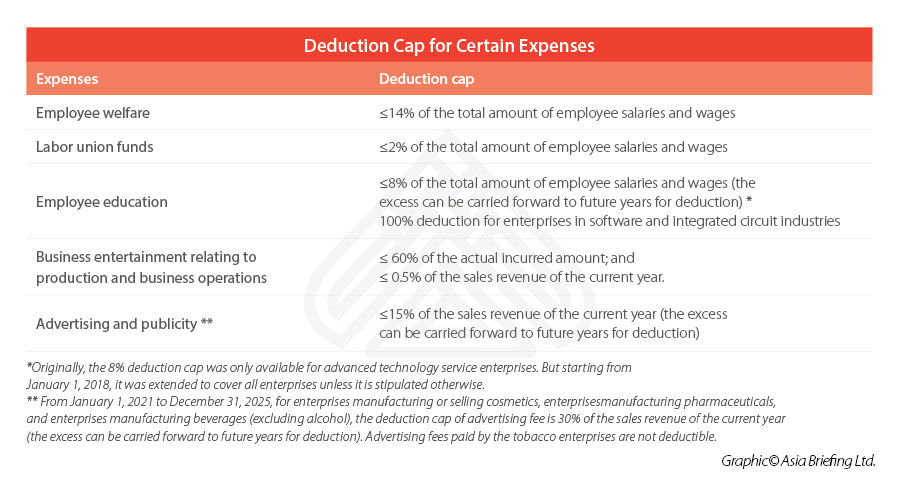

China Extends Pretax Deductions For Advertising Expenses By 5 Years

Income Tax Submission And Filing In Portugal

What Type Of Income Can Be Exempted From Income Tax In Malaysia

Updated Guide On Donations And Gifts Tax Deductions

Save Taxes You Can Deduct These Costs Swiss Life

Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia

3 Simple Ways For 100 Tax Deduction On Your Donation In Malaysia

Pin By Falakkk Shaikh On Attitude Is Mah Beautyy Funny Study Quotes Really Funny Joke Jokes Quotes

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

3 Simple Ways For 100 Tax Deduction On Your Donation In Malaysia

3 Simple Ways For 100 Tax Deduction On Your Donation In Malaysia

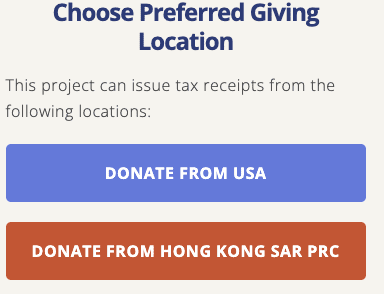

Tax Benefits For International Giving Give2asia

3 Simple Ways For 100 Tax Deduction On Your Donation In Malaysia

3 Simple Ways For 100 Tax Deduction On Your Donation In Malaysia

Updated Guide On Donations And Gifts Tax Deductions

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Newsletter 40 2019 Income Tax Deductions For The Employment Of Disabled Persons Amendment Rules 2019 Page 001 Jpg

Comments

Post a Comment