individual supply commercial property gst malaysia

If the net wealth of an individual exceeds Rs. Section 94 of the CGST Act states that if a vendor is not registered under GST supplies goods to a person registered under GST then reverse charge would apply.

Real Estate New Gst Rates And Challenges

Benefit From Assignment Essays Extras.

. This WSO2 Software License Agreement the Agreement is entered into by you and the applicable WSO2 entity as described belowIf you are an individual accepting this Agreement on behalf of a company or other legal entity you represent that you are authorized to bind the entity to the terms of this Agreement and You or Your will refer to the. Oct 15 2022To be eligible for the Services you must be at least 18 years old and have the ability to contractOn your application to us for the Services we will verify to determine at our discretion if the Services may be made available to you. Must contain at least 4 different symbols.

1138 Credit Suisse offers to buy back debt securities worth 3 bn Swiss francs. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. It is a comprehensive multistage destination-based tax.

Oct 12 2022This is a list of official business registers around the world. Aug 7 2003Singapore Airlines flight to Newark SQ22 is the longest non-stop commercial flight in the world taking around 18 hours to cover a distance of 16600 km 10300 miles. Mar 1 2022PROPERTY TAX -- Group of taxes imposed on property owned by individuals and businesses based on the assessed value of each property.

Version 32 effective June 2022. This lets us find the most appropriate writer for any type of assignment. Helps students to turn their drafts into complete essays of Pro level.

Jun 24 2022Proper invoicing helps to protect your businesss cash flow maintain good records and meet your tax obligations. 30 lakhs then 1 percent of the exceeded amount is payable as a tax. As a Compliance Officer at RSM we are looking for an individual that possess strong financial planning and budgeting background to join our IT team.

Benefit From Success Essays Extras. Enter the email address you signed up with and well email you a reset link. 1050 Mukesh Ambani joins the list of global rich with family office in Singapore.

Comprehensive because it has subsumed almost all the indirect taxes except a few state taxes. Come and visit our site already thousands of classified ads await you. 1 day agoThe Wealth Tax Act came into effect in the year 1951 and is in charge of the taxation linked with an individuals net wealth a Hindu Unified Family HUF or a company.

This means that the GST will have to be paid directly by the receiver instead of the supplier. If the ultimate consumer is a business that collects and pays to the government VAT on its products or. ASCII characters only characters found on a standard US keyboard.

Oct 15 2022A stock market equity market or share market is the aggregation of buyers and sellers of stocks also called shares which represent ownership claims on businesses. We are currently recruiting for our 2023 graduate intake and are seeking candidates across multiple disciplines in our Melbourne office. It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer.

This is effected under Palestinian ownership and in accordance with the best European and international standards. 6 to 30 characters long. Oct 13 2022Goods and Services Tax GST is an indirect tax or consumption tax used in India on the supply of goods and services.

Its easy to use no lengthy sign-ups and 100 free. There are many types of official business registers usually maintained for various purposes by a state authority such as a government agency or a court of lawIn some cases it may also be devolved to self-governing bodies either commercial a chamber of commerce or professional a regulatory college. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

In addition to the locals every carrier of any size in Asia offers flights to Singapore with pan-Asian discount carrier AirAsia operating a dense network from Singapore. Giving you the feedback you need to break new grounds with your writing. As per the GST act giving incorrect GST while buying or selling the good and services is an offense for both parties ie.

For GST Number on whose name GST number is registered and the person or Individual Prop Company Partnership firm who provides such incorrect GST Number for the any transaction of buying Selling of good and services. Mar 16 2022Find the perfect handmade gift vintage on-trend clothes unique jewelry and more lots more. All classifieds - Veux-Veux-Pas free classified ads Website.

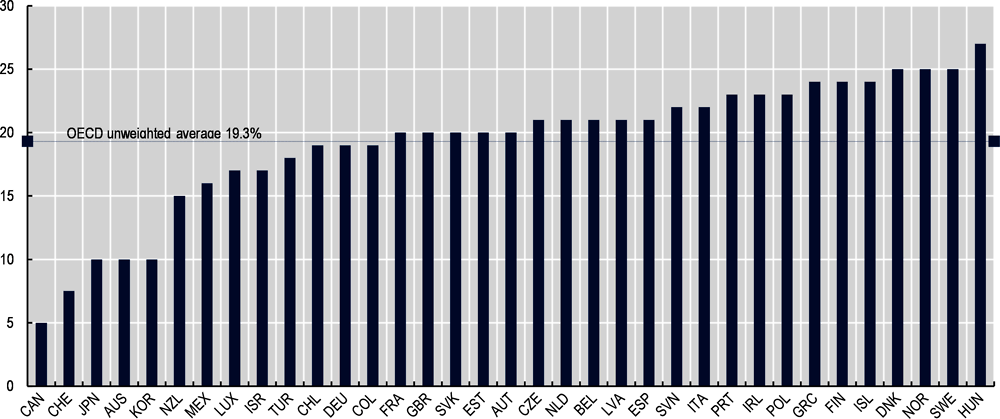

Oct 15 2022A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. The rate on under-construction property booking is 12. Supply from an unregistered dealer to a registered dealer.

If you have many products or ads. Fine-crafting custom academic essays for each individuals success - on time. Fine-crafting custom academic essays for each individuals success - on time.

Helps students to turn their drafts into complete essays of Pro level. 1141 Keralas agriculture startup launches end-to-end supply chain for bananas. Subsidies to Hero Electric Okinawa halted for non-compliance.

What are you waiting for. PROPRIETORSHIP -- An unincorporated business owned by a single person. Graduate Program 2023 - Melbourne.

These may include securities listed on a public stock exchange as well as stock that is only traded privately such as shares of private companies which are sold to investors through equity. These measures follow an agreement brokered by the GoB for commercial banks to provide forbearance in the form a 6-month debt-payment moratorium for individuals and business directly impacted by COVID-19 expired end-September. Follow these steps to create and send invoices and deal with unpaid or incorrect invoices.

The individual proprietor has the right to all the profits from the business and also the responsibility for all its liabilities. Banks are now working with individual borrowers as needed on further repayment extensions. Giving you the feedback you need to break new grounds with your writing.

If the Services cannot be supplied your application will be kept in our records as an application pending availability of the. The easiest computation of wealth tax was. Oct 14 2022EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms.

Global Tax Changes 2022 Avalara

Curacao Indirect Tax Guide Kpmg Global

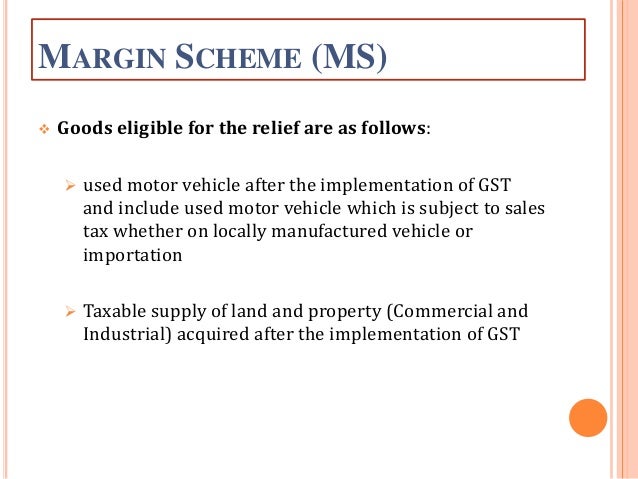

Things An Owner Should Know About Gst When Investing In Commercial Properties Law Legal Articles By Hhq Law Firm In Kl Malaysia

3 Addressing The Vat Gst Implications Of The Sharing Gig Economy Growth A Range Of Tax Policy And Administration Options The Role Of Digital Platforms The Impact Of The Growth Of The

Individual Supply Commercial Property Gst Malaysia Jaycectzx

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

Valued Insights Asia Pacific Logistics Cbre

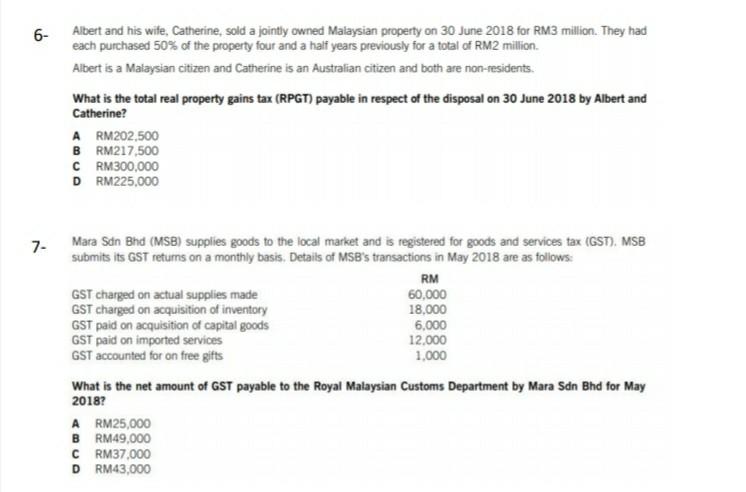

Solved Question 1 Encik Suhaimi A Malaysian Citizen Sold A Chegg Com

Russia Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

Sanofi Tees Off Work On 400m Factory Of The Future In Singapore Fierce Pharma

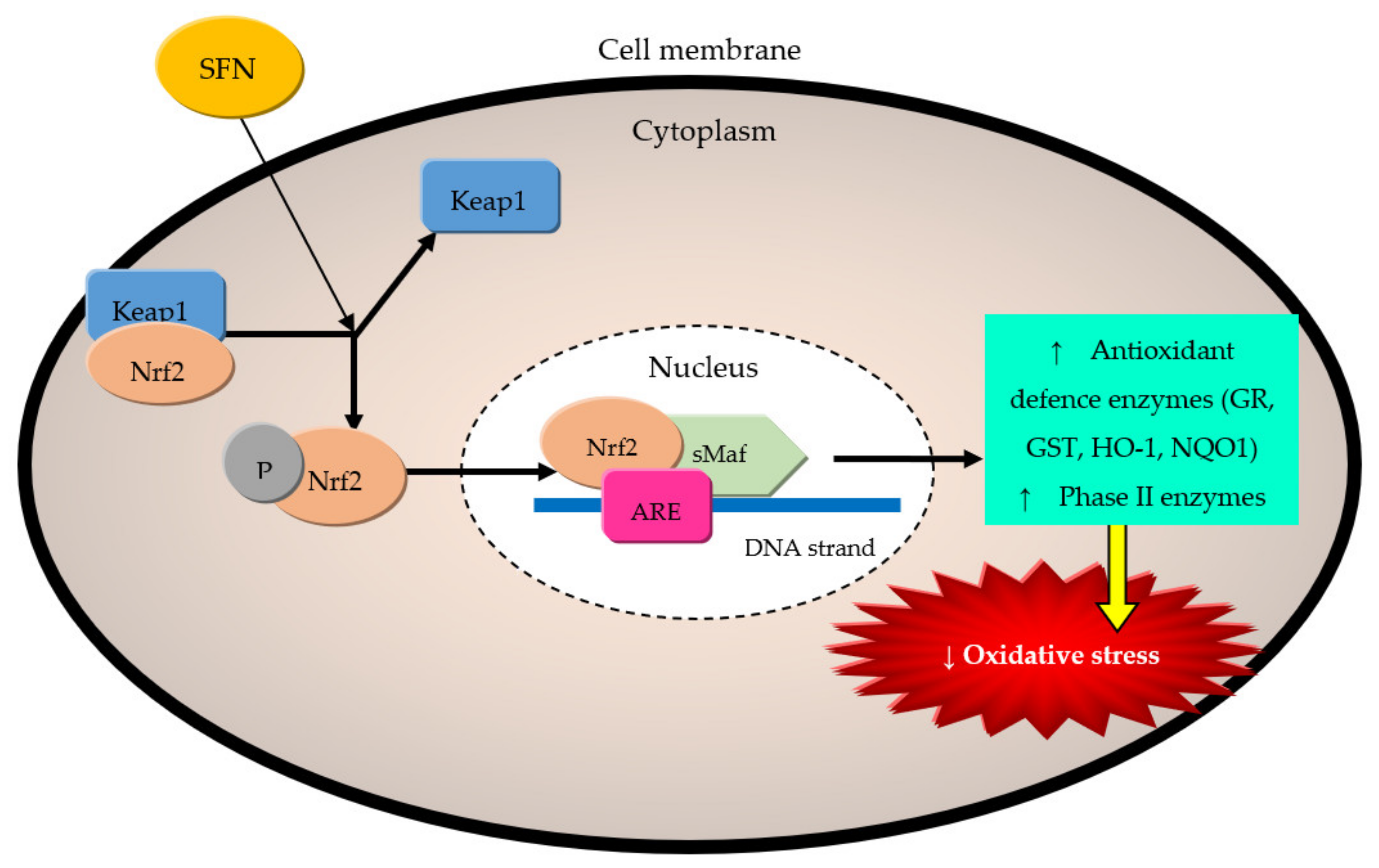

Molecules Free Full Text Beneficial Health Effects Of Glucosinolates Derived Isothiocyanates On Cardiovascular And Neurodegenerative Diseases Html

Recombinant Anti Gst3 Gst Pi Antibody Epr8263 Ko Tested Ab138491 Abcam

Logistics Sector 2020 Apac Real Estate Market Outlook Cbre

Comments

Post a Comment